total results

- Transportation and Logistics

- Public Sector

- Construction and Real Estate

- Insurance

- Cryptocurrency and Digital Assets

- Aerospace, Aviation and Defense

- Telecommunications, Media, and Technology

- Healthcare and Life Sciences

- Retail and Consumer Goods

- Energy

- Private Equity

- Financial Services

- High Net Worth Individuals and Family Offices

- 5 Tips For Meeting DOJ’s New CCO Certification Requirements

- Where’s the Beef? Demonstrating “Timely & Appropriate” Remediation

- Investing in a Culture of Compliance During an Economic Downturn

- Five Ways to Calculate ROI on Compliance

- Five Practical Steps to Maximize DOJ M&A Safe Harbor Benefits and Minimize Enforcement Risks

- From Art to Science: Unveiling the Transformative Power of AI in Surveys and Interviews

- Remediation Still Reigns Despite DOJ’s White Collar Shake-Up

- Pandemic Pushes Compliance Envelope

- PLI: “SEC and DOJ-Imposed Monitors”

- With Layoffs Looming at Wells Fargo, Compliance and Hiring Experts Say Bank Will Go Slow Cutting Compliance Staff

- A Primer in Root Cause Analysis: A Critical Step in the Remediation of Compliance Violations

-

FCPA Turns 40:

The U.S. Foreign Corrupt Practices Act —

A Look Forward and Back - Certification of Ethics and Compliance Program Effectiveness

- Preparing for the AI Agent Revolution: Navigating the Legal and Compliance Challenges of Autonomous Decision-Makers

- Risk Management: Forget the Lake. Data Farms Offer Better Intelligence and Support

- Remediation Roadmap: 5 Steps for Timely and Cost-Effective Corrective Action

- Data Analytics Maturity Assessment of Compliance Programs: A Practical Guide

- StoneTurn Spotlight: Joshua Dennis

- Data Analytics in Compliance: It Doesn’t Have to Be the Death Star

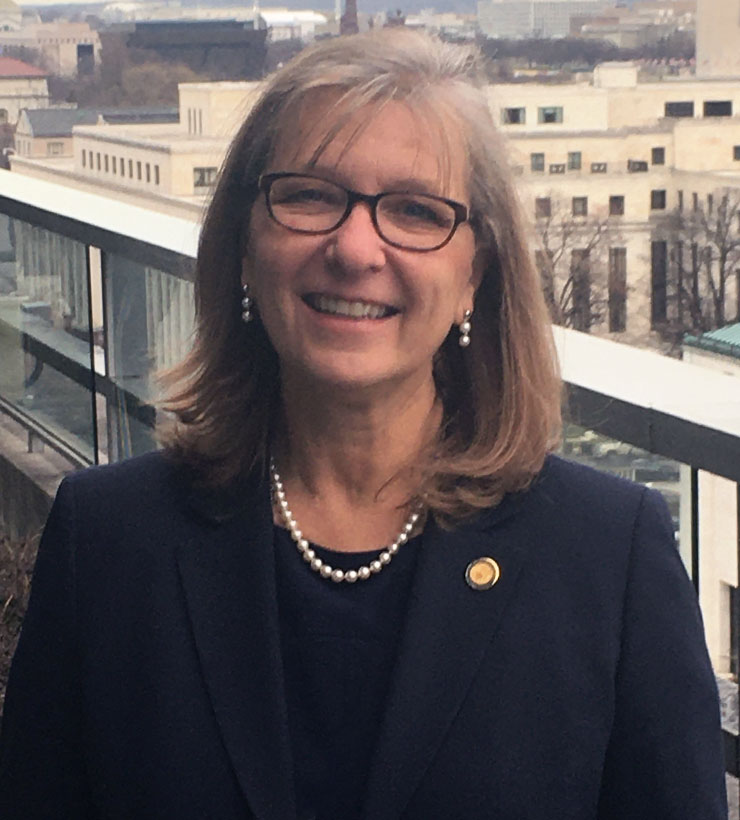

- StoneTurner Spotlight: Laura Greenman

- AI-Powered AML: Revolutionizing Financial Crime Compliance

- Corporate Monitorships: Lessons We’ve Learned for Today’s Compliance Programs

- Does Your Compliance Program Meet New DOJ Priorities?

- 20 Years of Trends: Reflections and the Future

- No Longer Under Wraps — SEC Wrap Fee Scrutiny on the Rise

- The Next Chapter in Sanctions Due Diligence

- 5 Steps To Meet CFTC Remediation Expectations

- Accelerating Cybersecurity Assessments with Large Language Models

- The Digital Transformation Imperative in Compliance

- PODCAST: The Value of CEO and CCO Certifications

- Compliance-Related Diligence Protects M&A ROI

- Securing a C-ADR: Leveraging Compliance Readiness and Steps for Independent Reviews

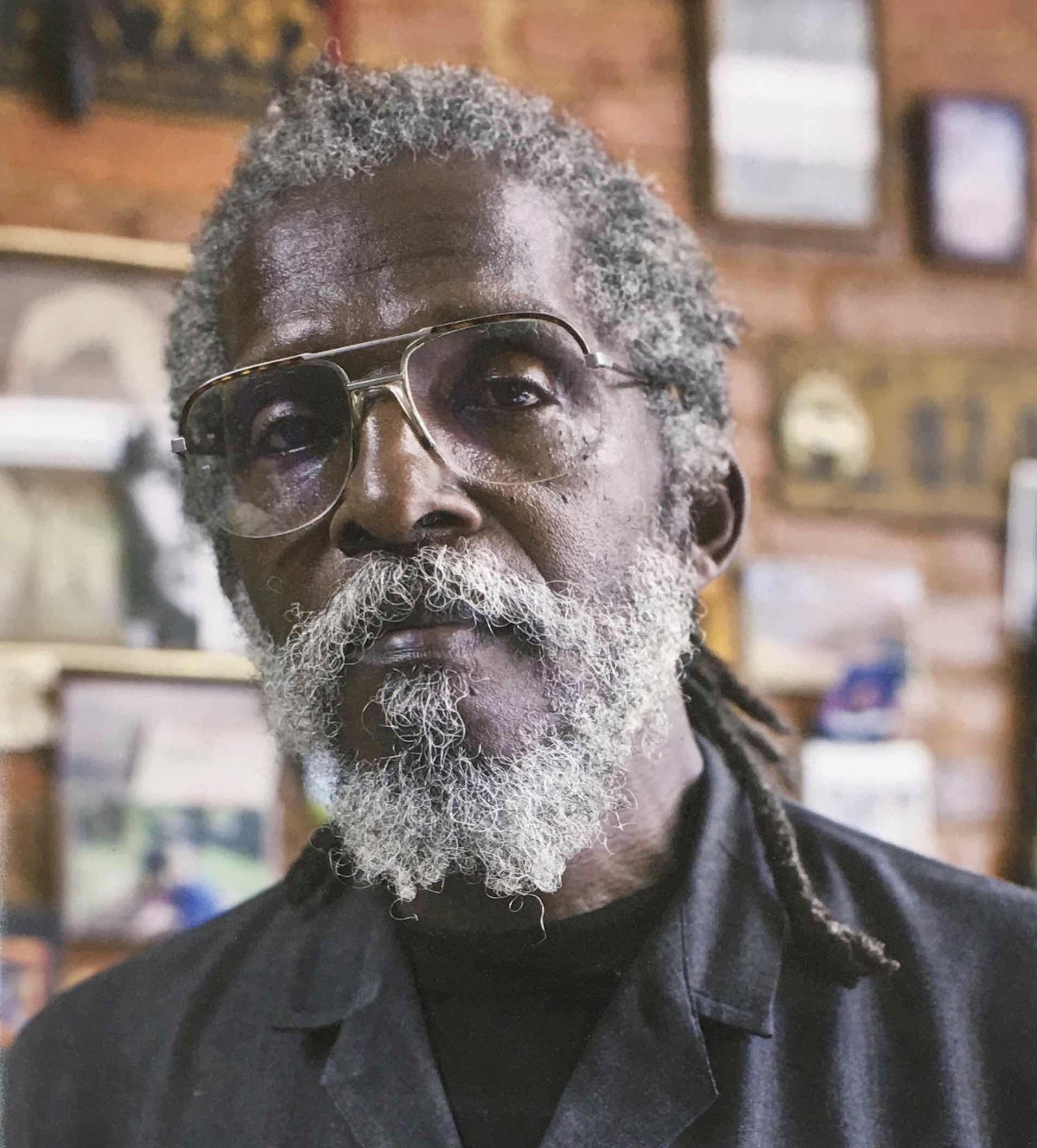

- StoneTurner Spotlight: Jonny Frank

- Using Big Data Analytics to Combat White-Collar Crime

- Why Energy Trading Cos. Must Review Electronic Comms Policies

- Meeting DOJ and SEC Post-Settlement Obligations: A Practical Guide

- Ethics & Compliance Professional as Cardiologist: How to Avoid and Recover from Corporate Heart Attacks

- Greenwashing, Greenhushing, and Greenbashing: Risks and Perils

- StoneTurner Spotlight: Cindy Yu

- Beyond Whistleblowing: Five Steps to Establish an Effective Speak-Up Program

- Whistleblower Day 2023: The (R)evolution of Speaking Up

- DOJ Increases Focus on Data in Compliance Guidance Changes

- Remediation of Corporate Misconduct and Regulatory Violations: 6 Key Questions

- Foreign Companies Investing in U.S. Real Estate: Are You a National Security Risk?

- The GC as a Value Driver: Insights to Help Prepare, Protect and Prosper

- New Challenges Arise as Workers Return to the Office — or Don’t

- Preventing Trade Allocation Pitfalls

- Is There an ROI on Compliance Investment?

- SEC-Imposed Monitors, 2021 Edition

- SEC-Imposed Monitors

- Sweeping Skeletons Out of the Corporate Closet: “Read Across” and Remediation

- Be Prepared for CFIUS: Mitigating Vulnerabilities with an Insider Risk Program

- Whistleblowing Legislation in the EU and Brazil: The Complete Compliance and Ethics Manual 2024

- Trust and National Security: Lessons for Business Insider Threat Programs

- How Evolving ESG Disclosure Regulations Impact You

- ESG is a Four Act Play and Intermission is About to End

- Expert Series Q&A: June Sim, Managing Director, SGX RegCo

- The Importance of Having a National Security Strategy

- 4 Critical Steps for Responding to Whistleblower Complaints

- Mastering The High Stakes of Insider Risk Management

- StoneTurn Spotlight: Shari Schindler

- Navigating Opportunities in Latin America in 2025

- How Can Audit Firms Respond to Ongoing Regulatory Scrutiny?

- On Your Marks, Get Set, Go: The Race To Disclose Corporate Misconduct

- Measuring ESG to Manage and Drive Sustainable Change

- How Do Suppliers Manage Counter-Party Risk During the Pandemic?

- Are Voluntary Monitors the Key to Mitigating COVID-19-Related Misconduct Risks?

- A Practical Guide for Navigating the EU’s Whistleblower Protection Directive

- Mitigating National Security Threats in Commercial Transactions

- Cryptonews: NFTs and ‘Insider Trading’—How to Stay in Compliance

- EU Whistleblower Directive: The Complete Compliance and Ethics Manual

- Building a Successful Compliance Analytics Function

- Breaking Down the DOJ’s Whistleblower Pilot Program

- Compliance Matters: Meeting SFO Expectations

- Integrity: Its Role in Compliance and a Tool in Corporate Decision Making

- 8 Critical Actions to Enjoy the Carrot & Avoid the Stick of DOJ’s Corporate Enforcement Policies

- Aligning Cybersecurity Risk with Business Imperatives

- Silence is Not Golden: Five Metrics and a Scorecard for Measuring Speak-Up Culture

- Act Now, Document Your Work to Satisfy New DOJ Compliance Guidelines

- Data Analysis Underlies New DOJ Guidance

- A Tale of Two Industries: Indonesia’s Local Content Requirements

- Cryptocurrency: Coming Soon to a Financial Institution Near You?

- The Role of Data Analytics in Regulatory Inquiries

- Insights for World Whistleblower Day 2021

- Using Data Analytics to Improve Audit Functions

- The Going Concern Question in the COVID-19 Crisis

- Leverage Data Analytics to Curb Fraud Risks

- Financial Regulatory Investigations and Disputes

- SEC-Imposed Monitors

- Revisiting Conduct Risk Management in the COVID-19 Era with Updated DOJ Criteria

- Bullying in the Workplace: A Harbinger of Serious Problems

- Amid Shifting Business Landscape, the GC’s Role—and Value—Are Expanding

- The Parallels Between Winning Sports Teams and Successful Construction Projects

- Comply Now: Six Regulatory Considerations for Non-Bank Lenders and Payments Processors

- 10 Tips to Meet Government Expectations of Remediation Programs

- Five Steps Lenders Can Take to Mitigate PPP Loan Fraud Risks

- Uncovering Bribes Hidden in Books and Records

- A Step Ahead – Cybersecurity Insights Business Leaders Need Now

- Risk Awareness and Mitigation in Disaster Recovery: After a Catastrophe

- 2025 and Cybersecurity: What is Your Strategy?

- Two Decades and Beyond: A Shifting Landscape & Predictions for the Future

- Navigating the Shifting Risk Landscape: Insider Threats and Global Challenges

- Leveraging Integrity Monitors to Safeguard Corporate Resources

- Greenhouse Gas Reductions: Finding Your Way Forward

- Carbon Inventories: California Here We Come!

- The Changing Role of the GC: Insights That Matter

- Maintaining Effective Corporate Compliance Programs Under DOJ’s Heightened Standards: Webinar

- 5 Ways to Meet DOJ’s Heightened Compliance Expectations

- Cyber Pulse: H1 2025 Threat Landscape Review

- Building a High Trust Organisation

- CFIUS is not alone: Global FDI regimes

- Three Steps to Prepare for CFIUS Switch to Export Control Standard

- Your Financial Controls Probably Don’t Work Under Today’s Conditions

- Operationalizing the N.Y. Department of Financial Services Character and Fitness Guidance

- The General Counsel: Risk Managing in a Complex Geopolitical World

- M&A Risk Management Considerations Amid War In Ukraine

- SEC Continues Enforcement Under Its EPS Initiative

- How to Maximize PPP Loan Forgiveness: 6 Practical Steps

- StoneTurn Spotlight: Sarah Keeling

- New York State Set to Enact the Nation’s Most Robust Anti-Harassment Legislation

- From Risk To Reward: Exploring The Dynamics Of ‘Good’ Fraud

- Expecting the Unexpected: Tips for Effectively Mitigating Ransomware Attacks in 2021

- 9 Tips To Ensure Deal Success Under Growing CFIUS Scrutiny

- China’s Updated Anti-Corruption Regulations

- Fraudopedia Podcast: Can Some Good Come Out of Fraud?

- Bias in Compliance: How to Identify and Address It

- Is a Fraud Pandemic Around the Corner?

- Putting Biden’s Executive Order into Action

- The United Kingdom Strengthens Its Foreign Direct Investment Procedures

- Export Controls Claim Spotlight as CFIUS Shifts Approach

- Tackling Multijurisdictional Fraud Schemes

- 3 Ways To Use Data Analytics To Reduce Risk

- StoneTurn Spotlight: Scott Boylan

- Remediation

- Know Your Customer vs. Know Your Intermediary

- Looking Back: AFA President Reflects on Nine Months of Sapin II and What to Expect

- Practical Guidance for Protecting Assets and Reducing Risk

- Geopolitical Uncertainty And The Board: Preparing for What’s Now And What’s Next

- How To Meet CFIUS Expectations for Chinese Investment

- Post-Brexit Fraud Considerations in the UK and EU

- Oman: Attractive Investment Prospects, Approach with Diligence

- SEC Is Watching Earnings Management Disclosures

- Could There Be Internal Controls Violations in Cyber-Fraud Cases?

- CFIUS: Three Trends to Know

- Prepare Now for New Anti-Corruption Program Expectations

- NCSC Warns U.S. Startups and Investors of Foreign Bad Actors with Money to Spend

- Risk Awareness and Mitigation in Disaster Recovery: During a Catastrophe

- How Is Fraud Being Perpetrated In Your Organization?

- Shifting Cyber Landscape – Crisis Awareness as a Means to Prevent and Prepare

- Key Elements of Effective FCPA Remediation: Earning DOJ and SEC’s “High Premium”

- Navigating Litigation in the Age of Big Data

- StoneTurner Spotlight: Piers de Wilde

- StoneTurn Celebrates 20 Years

- Can Understanding Insider Risk Help to Prevent Fraud?

- National Cybersecurity Strategy: Potential Impacts To Consider

- eDiscovery and Forensic Investigations: Six Tips for Managing Company Messaging Protocols

- Looking for a Trusted Advisor?

- Full Disclosure: It is Time to Come Clean on Crypto’s Wash Trades

- Owners and Contractors Beware – Vendor Risks Can Hurt Your Projects

- Are you ready for ESG as a critical business imperative?

- Reducing Regulatory Exposure: The Priceless Cyber Question

- The Importance of Proactive Construction Schedule Risk Management For Owners

- Technology and Data Can be Powerful Fraud Investigative Tools or Create Massive Headaches. Need an Advil?

- Winning a seat at the ESG table

- Impact of the Supreme Court Title VII Ruling

- Forensic Analytics Can Find Needles In Multiple Haystacks

- The SEC and Private Funds: New Year, Same Focus

- Five Ways to Prepare for the New French Anti-Corruption Law

- Email Impersonation Scams Costing Billions, AICPA Warns

- Advance in Africa: Investment, Innovation & Growth Trends

- Legal Investigations: Digging Deeper into White-Collar Crime and Financial Crime

- Southeast Asia’s Growing Role in EVs: Mitigating Your Supply Chain Risks

- Sanctions and The Impact on Brazilian Companies

- 5 Tendências Positivas para Investimentos na América Latina e Mitigação de Riscos em 2024

- Inside The Fraud Lab Podcast: Dave Burroughs on Insider Risk

- SEAscapes: Risk Insights for Southeast Asia

- In Transition: Malaysia after the 15th General Elections

- Insider Risk and The Protection of Critical Trade Secrets

- Integrity as a Means of Internal Control

- Blockchain Investigators Put a Wrinkle in Crypto-Laundering

- Private Capital and the Energy Transition

- The Executive Order on Digital Assets and the Future of Regulation and Oversight

- 2021: Deal Fever and its Implications for Private Equity Investing

- Spilling the Beans: 10 Practical Steps to Improve Your Whistleblowing Framework

- What You Need To Know Before Adding Cryptocurrencies To Your Balance Sheet

- SPACs Boom: Too Good To Be True?

- Navigating Inability-To-Pay Claims with DOJ Amid COVID-19

- Data Security Considerations for Companies with a Remote Workforce

- 5 Steps Your Clients Can Take to Weather Mandatory PPP Audits

- U.S. Strengthens Data-Rich Inbound Investment Rules

- How Data Analytics Can Weed Out College Admissions Fraud

- Accountant Shortage Demands Proactive Steps From Business Leaders

- Howard Scheck on Trends in SEC Enforcement

- Worth Magazine: New Regulations Art Buyers Need to Know About

- Assessing the Iranian Cyber Arsenal: Post “12 Day War” Threat to Your Company

- 5 Positive Investment Trends for Latin America & Mitigating Risk in 2024

- There’s Still Time to Maximize Inflation Reduction Act Incentives

- A Ameaça Interna: Mitigando Riscos no DNA da Sua Organização

- New U.S.-China Investment Dynamic Focuses On AI and Sensitive Technologies

- The Insider Threat: Mitigating Risk Within the DNA of Your Organization

- Sports and Cyber Fraud: What You Need to Know

- Brazil – Outlook and Opportunities for Investment in 2023

- Risk Mitigation Strategies: The Game Series

- Driving Towards Net Zero: How the Inflation Reduction Act Can Move Your Organization Ahead

- Intelligence Matters

- Cyber Risk Monitor: May 2021

- Guyana and Suriname: The Next Five Years

- COVID-19 Fraud and Economic Crime: Risks & Mitigation Strategies

- CFIUS Still Approving Well-Prepared Chinese Deals

- Fraud Prevention as a Competitive Advantage

- Remediation Can Help Avoid Prosecution, Reduce Fines

- Will France Expand the Scope and Reach of its Anti-Corruption Agency?

- 5 Ways to Eliminate the Need for a Corporate Monitor

- NexGen White Collar: Five Ways to Maximize a Fast-Changing Market

- Podcast: Defending National Infrastructure in a Rapidly Evolving Threat Landscape

- Tariffs, Turbulence And The Strategic Role Of The Board

- Do You Know Who Your Employee Is? Mitigating DPRK IT Worker Risk

- The Forensic Practitioner Profiles Louise Jordaan

- When It Comes to Sanctions, PE Firms Must Proceed with Great Caution

- Experts Series: Spotlight on Singapore

- Transaction Monitoring: The Next “Must-Have” Anti-Corruption Tool

- 7 Tips for a Successful Analytics Maturity Assessment

- Reducing Adverse Legal Consequences Through FCPA Remediation

- Amy Foote to Discuss Return to Work Compliance Considerations in a Compliance Week Webcast

- A Good Compliance Monitor is also a Culture Monitor: Compliance & Ethics Professional

- StoneTurn’s Jonny Frank Appointed to Law360’s 2023 Compliance Editorial Advisory Board

- StoneTurn’s Jonny Frank Appointed to Law360’s Compliance Editorial Advisory Board

- StoneTurn to Assist Former Deputy U.S. Attorney General Larry Thompson as Corporate Compliance Monitor in Volkswagen AG Emissions Proceedings

- Jonny Frank Named to Law360 2025 Compliance Editorial Advisory Board

- StoneTurn’s Jonny Frank Again Appointed to Law360’s Compliance Editorial Advisory Board

- Jonny Frank Again Named to Law360’s Compliance Advisory Editorial Board

- Xavier Oustalniol Presents at SCCE’s 2018 Annual Compliance & Ethics Institute

- Firjan Panel Discussion, “Compliance and Public-Private Relations”

- RANE Webinar: Is There an ROI on Compliance Investment?

- SEC, Compliance, Internal Investigations & Whistleblowers

- Xavier Oustalniol to Present on Third-Party Risks at SCCE Compliance & Ethics Institute

- Event: Heightened Expectations & Risk Around Compliance Programs (Nov. 17)

- StoneTurn Adds David A. Holley as Partner in Boston, Further Expanding Investigations and Compliance Advisory Services

- Skillsoft and StoneTurn Partner to Help Organizations Better Identify and Mitigate Risk

- StoneTurn Proudly Welcomes Snežana Gebauer as a Partner in its New York Office as Part of its Continued Expansion of Investigations and Compliance Advisory Services

- Former U.S. Deputy AG Larry D. Thompson and Team Complete Monitorship in Volkswagen AG Emissions Proceedings

- Lemire LLC Team Joins StoneTurn

- StoneTurn Named Convercent’s Advisory Services Partner

- TRACE and StoneTurn Announce Strategic Alliance

- Four StoneTurn Partners Honored as Top Consultants by Consulting Magazine

- Make ESG a Strategic Priority Ahead of Imminent Regulatory Change, Says New Report

- Michele Edwards Joins StoneTurn in Chicago

- StoneTurn Adds Johannesburg-based Partners and Expands Global Footprint to South Africa

- StoneTurn Announces New Partners and Senior Promotions

- StoneTurn Ranks in Chambers’ 2022 Litigation Support Guide as a Leading Firm

- StoneTurn Promotes Three Global Professionals to Partner

- Paul Ryan Joins As A Partner Based in New York

- StoneTurn and Silverseal Selected by Oakland Police Department to Conduct an Independent Review of Personnel Practices

- StoneTurn Expands Senior Team in Washington, DC

- Event: “Trends and Hot Topics in SEC Enforcement” (Nov. 7)

- StoneTurn Professionals Recognized as Leaders in Technology by Consulting Magazine

- StoneTurn Enhances Crypto Investigations & Litigation Support Offerings with TRM Labs

- StoneTurn Bolsters Its Capabilities in Brazil with Two New Managing Directors

- StoneTurn Announces Senior Promotions Across the Globe

- Allen D. Applbaum Joins StoneTurn as a Partner Based in New York

- Howard Scheck to Speak on Panel at ABA 12th Annual National Institute on Securities Fraud

- StoneTurn Announces Expansion of Senior Leadership

- Recap: Trends and Hot Topics in SEC Enforcement

- Howard Scheck Joins StoneTurn as a Partner in Washington, DC

- StoneTurn Expands Cybersecurity Practice with Partner Steve Kopeck

- StoneTurn and Three Partners Recognized in 2024 IAM Patent 1000

- StoneTurn Expands Energy Transition Offering with Subterra Renewables Collaboration

- StoneTurn Opens Office in Singapore, Expanding Geographic Footprint to ASEAN Region

- StoneTurn Appoints Brad Wilson Managing Partner and CEO

- StoneTurn Bolsters Its Construction Advisory Practice with Addition of Randall Coxworth as a Partner in Los Angeles

- StoneTurn Named 2021 Investigations Consultancy of the Year

- StoneTurn Welcomes Paul Marcus and Jamal Ahmad, Continuing StoneTurn’s East Coast Expansion

- Michele Edwards Recognized as a Global Leader in Consulting by Consulting Magazine

- Effective Remediation in Internal Investigations

- Shari Schindler Joins StoneTurn as a Partner Based in Chicago

- StoneTurn Partner Katherine A. Lemire Appointed Executive Deputy Superintendent of the New York State Department of Financial Services

- Will DPAs Travel Across the Atlantic?

- Securities Docket Webinar: One Year Later – French Anti-Corruption Law (Sapin II) Update

- NexGen White Collar: Where Are the Law, Business and Ethics Headed?

- StoneTurn Partner Scott Boylan Recognized as Top Advisor for Foreign Investment, National Security

- StoneTurn Recognized in Three Categories for Consulting Magazine’s Women Leaders in Consulting

- Alan Ratliff and Ambreen Salters Again Recognized as Top Expert Witnesses by IAM Patent 1000

- StoneTurn Ranks in Chambers’ 2023 Litigation Support Guide as a Leading Firm

- StoneTurn Partners with Chainalysis Enhancing Investigative Services in Crypto, Litigation Support Offerings

- StoneTurn Professionals Recognized As Rising Stars by Consulting Magazine

- StoneTurn Assists GE Lighting, Current Lighting and Counsel Norton Rose Fulbright, Brooks Kushman in Patent Infringement Trial

- Who’s Who Legal: Consulting 2022 Recognizes Six StoneTurn Partners

- StoneTurn Assists Vicor and Quinn Emanuel with Damage Control in Patent Infringement Trial

- Jon Critelli Joins StoneTurn as Partner in Construction Advisory Practice

- Jonny Frank Speaks at Operation Chokepoint Panel Discussion

- StoneTurn Ranks in Chambers’ 2021 Litigation Support Guide

- StoneTurn Announces Senior Promotions Across the Globe

- StoneTurn Supports Independent Investigation into the Financial Conduct Authority’s Regulation and Oversight of London Capital & Finance Plc.

- Luke Tenery Joins StoneTurn as a Partner

- StoneTurn Expands Forensic Technology Offering with Addition of eDiscovery and Hosting Services

- StoneTurn Partners with MML Capital

- StoneTurn Continues to Expand Global Investigations Practice

- StoneTurn Named A ‘Best Consulting Firm To Work For’ By Vault

- StoneTurn Continues to Expand Global Investigations Practice

- Simon Platt recognized in Who’s Who Legal Investigations: Forensic Accountants 2019

- StoneTurn Announces New Partners and Senior Promotions

- Panel Discussion: Straight Talk: How Internal Audit Can Add Value In BSA / AML / Sanctions Remediations

- Brad Wilson Recognized with AICPA Standing Ovation

- Xavier Oustalniol Presents at PLI Pocket MBA 2018

- The Knowledge Group Webinar, “Forensic Accounting & Litigation: Hot Button Issues in 2018”

- Join us for a Directors Roundtable Institute Program on FCPA and Monitorships

- Building the StoneTurn Brand

- E-Mail Impersonation Scams Costing Billions, AICPA Warns

- StoneTurn and Three Partners Recognized in 2025 IAM Patent 1000

- StoneTurn Partner Scott Boylan Again Recognized as Top Advisor for Foreign Investment, National Security

- Xavier Oustalniol Joins StoneTurn in San Francisco

- Developing a Sanctions/OFAC Compliance Program for an International Travel Company

- Compliance Monitor to $500 Billion Mortgage Servicer

- Independent Compliance Auditor for a Top 5 Automotive Manufacturer

- Independent Compliance and Business Ethics Monitor – Leading Global Investment Bank

- Comprehensive Compliance and Risk Management Review for a Leading Environmental NGO

- Digital Asset Monitoring for a Foreign Government

- Assessment of a Global Animal Health Company’s Global Trade Program

- Sanctions Guidance for a Global Infrastructure Fund Following Russia’s Invasion of Ukraine

- DOJ appointed Independent Compliance and Business – Top Global Investment Bank

- AML and Sanctions Compliance – Digital Asset Custodian

- Review of Loan Servicing Activities for Residential Mortgages

- Forensic Adviser to FCPA Monitor – Global Investment Manager Entity

- Forensic Adviser to the Monitor of a large Financial Services Institution

- Integrity Monitoring for a Top 5 Global Financial Institution

- Remediation Consultant – Large Northern European Bank

- Digital Asset Payment Administration and Monitoring – Foreign Government

- Vendor Investigation – Global Financial Institution

- Government-appointed Monitor – Large Hedge Fund

- Internal Investigation into Potential Misuse of Cash Accounts

- Mortgage Foreclosures Review

348

There are no results for your search terms.