Christian Gordon, a Senior Consultant with StoneTurn, is a co-author of this article.

Vendor risk has the power to impact an organization’s reputation, ESG (environmental, social, governance) initiatives, and information security. Similarly, vendors can affect a project’s performance due to their financial and credit situations, legal and organizational compliance issues, geo-political scenarios, and general decision-making. These vendor risks, among others, are here to stay and are continuing to grow—with the ability to negatively impact owners and contractors alike.

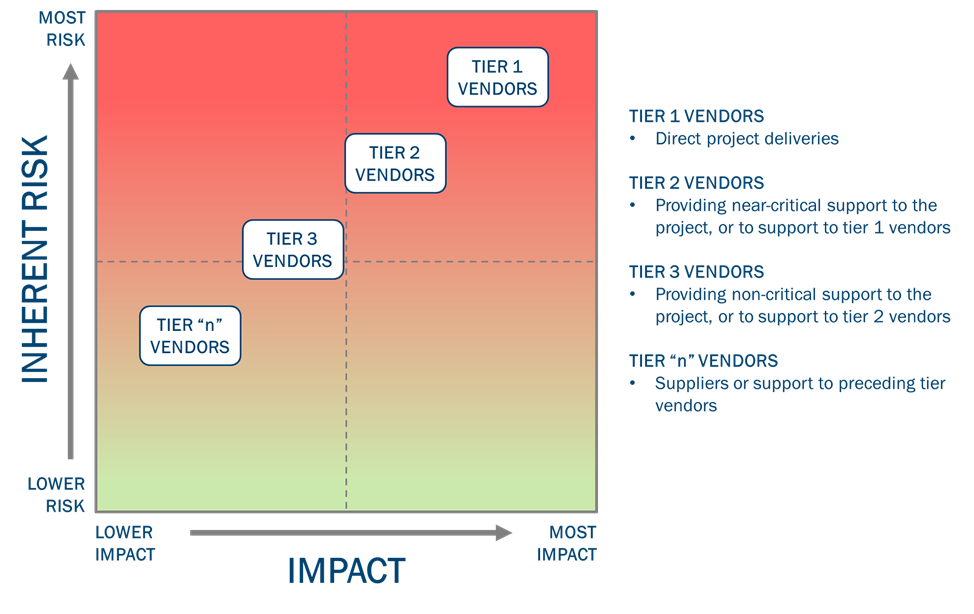

Awareness of vendor risk is critical for owners, as they are not isolated from risks even though construction managers and general contractors are typically the ones who directly engage vendors. Vendors can be classified into general tiers as shown in Figure 1 below.1 Tiers range from high project impact, and therefore higher risk (vendors in tier 1), to non-critical vendors or suppliers with low impact and risk in the nth tier. Although third or nth tier vendors typically originate as lower risk vendors, improper risk management practices can increase the impact and risks associated with these vendor’s scope on the project. Therefore, it is very important to manage your vendor risks regardless of the original tier classification.

Figure 1: Heat Map Depicting Vendor Tiers

Mitigating Vendor Risk

Research and due diligence are critical in identifying risks within the vendor ecosystem. Practices can range from conversations with specific vendors, investigations for bad press or reputational red flags, and leveraging your network and previous experiences with vendors. Be aware of all the direct and subcontracted vendors and suppliers on your project and make certain those vendors meet your required qualifications for the project. Risk identification should be conducted prior to engaging your vendors through the examination of key vendor risk questions such as:

- Are your vendors accounting for potential increases in costs and delays to equipment and material deliveries?

- Are your vendors expediting their equipment and is there oversight into these actions? How are these costs being passed to the project, and therefore the owner and contractor?

- How are your vendors staffing projects and ensuring the use of quality labor?

- Are your vendors compliant with applicable labor laws and are your vendors verified to work on your projects?

- Do you have insight into vendor’s cashflow, credit and debt situations, cashflow management, and projection capabilities and processes?

- Are payment terms, cycles and structures understood and agreed upon by all stakeholders on your project?

- How will changes and disputes be handled via the contract?

- Are you aware of the quantity of projects in your vendor’s backlog and how your project fits?

Owners and contractors rely on their vendors to support significant portions of projects throughout the project lifecycle. As a result, the ability to identify, mitigate and monitor vendor risk is crucial to the successful completion of every project. In the current market, many vulnerabilities exist regarding vendor risk including, but not limited to, supply chain delays, labor shortages, cash flow, and project backlog.

Supply Chain Delays

From equipment to materials and virtually everything in-between has experienced delays, price increases, and other impacts in the supply chain. Supply chain issues are not a new phenomenon but have intensified and impacted many industries since the start of the COVID-19 pandemic. As a result, owners and contractors need to have insight into their exposure to delays in the supply chain—and have a “plan B” to account for such delays.

In the construction industry, electrical components and HVAC equipment have experienced some of the most dramatic increases in lead times, attributable to both the increase in quantity of orders and supply chain delays:

- In the second quarter of 2022, compared to one year prior, electrical equipment orders are up 9.1% and mechanical equipment orders are up 13.3%.2

- Lead times for generators, switch gears, air handlers, and other electrical and mechanical equipment have grown to 12-18 months and delivery time estimates often shift dramatically according to the September 2022 Issue from Building Congress & Exchange.3

Although vendors may be providing expected lead times, additional delays have been occurring as the originally anticipated delivery dates approach.

In this current environment, it is difficult to predict delivery timelines when lead times can, be more than a year in the future. Additionally, risks can exist with options to pay for expedited delivery on long lead equipment and materials. With these supply chain uncertainties and delays, expedited delivery fees still may not guarantee the early or on time arrival of critical equipment and materials.

Measuring and monitoring the potential risks vendors may be exposed to is critical for managing the overall project risks and challenges owners and contractors currently face. A vendor’s supply chain management practices can potentially impact a project’s delivery timeline and increase costs. Understanding vendor’s actions regarding supply chain risks will provide the insight necessary to manage these risks.

Labor Shortages

Workforce shortages, which have become more widespread since the start of the COVID-19 pandemic, have proven particularly costly to the construction industry. Unemployment soared during the initial phases of the pandemic as many industries grinded to a halt, impacting the quantity and quality of available labor. Job site safety, project schedules and the ability to complete current projects and staff upcoming projects are all compounded by the labor shortages.

The numbers are telling a startling story. According to the Association of General Contractors (ACG) 93% of construction firms have open positions, largely in craft labor which performs most of the onsite construction work. Similarly, 77% of the firms surveyed by ACG indicated that candidates lack the qualifications needed to work and that 66% of firms have projects delayed due to labor shortages.4 These high percentages indicate that most construction projects have a likelihood of being impacted due to labor related issues. Hiring inexperienced or lesser qualified personnel and understaffing projects can lead to safety and quality issues. These factors can also lead to inefficient progress, schedule delays and increased training and supervisory costs.

Because a project’s labor force is crucial to the construction of your project, it is important to understand your vendor’s intended labor force prior to engagement. An unskilled or understaffed labor force will negatively impact milestones, quality and therefore, can lead to disputes or claims on your project.

Cash Flow & Backlog

Steady cashflow is the most critical item for construction companies and their vendors, especially as second tier, third tier, and nth tier vendors are utilized. Materials, equipment, and labor are requiring an increasing amount of funding, notably as inflation rises, and companies strive to grow their business. Late or missed payments, payment term structure and large or sudden project costs can put a vendor at risk of defaulting on project obligations.

To remain competitive, vendors often submit the leanest possible bid to win project work. This trend is prevalent when fewer projects are available for bid in the market, increasing the quantity of vendors competing to secure one project. Reducing margins in a bid directly correlates to lower profit margins, if awarded the project. According to Associated Builders and Contractors (ABC) Chief Economist Anirban Basu, several months ago contactors reported surging backlog and an ability to pass along hefty cost increases to project owners. For months, contractors expected sales, employment and margins to expand. The most recent ABC survey indicates that, to secure work and to induce project starts, a growing number of contractors are trimming margins.5 These force-trimmed margins may push many contractors to cut costs via other avenues to maintain sufficient cashflows to support active projects and fund projects in the backlog.

Although there are common expectations or observations that COVID-19 impacts are residing and industry growth will resume to pre-pandemic levels, ABC’s Construction Backlog Indicator (CBI) shows an otherwise lack luster trend. ABC’s (CBI) shows a relatively flat trend with an overall increase of 0.2 months in the July 2021 to July 2022 timeframe. The CBI states the 12-month change in commercial and industrial CBI rose by 0.6 months, heavy industrial CBI decreased by 1.5 months and infrastructure CBI decreased 2 months.6 Market risks including increasing interest rates, compensation costs, equipment and material costs, and labor shortages are all also impacting the quantity of work in vendor’s backlogs.

Out of the three areas of risks discussed, owners and contractors may have the least amount of awareness into a vendor’s cashflow or financial situation and their backlog. However, a vendor’s cashflow and backlog situation still has the potential to negatively impact your project. Therefore, research and due diligence into the selection of vendors is critical to ensure vendors are in a situation to both fund their project expenses and can dedicate the resources necessary to the successful completion of the project.

Conclusion

It is important to plan ahead and be prepared along with monitoring and managing emerging vendor risks across all phases of the project lifecycle. The trends discussed above have become the new normal and do not appear to be slowing or changing in the near future. The risks associated with these market trends can, however, be mitigated with the appropriate risk management practices specific to vendors and vendor engagement.

Insight, research, active participation, and due diligence are the key tasks to identifying, mitigating, and monitoring vendor risk on a project. Understanding the current market climate at the end of 2022, and where many of these trends will continue into 2023, is essential to make the appropriate and effective decisions to control vendor risk. Although vendor risk is not possible to eliminate entirely, having the appropriate processes, procedures and people in place will ensure your projects are not derailed by pending risks.

1 Construction projects are dynamic and project conditions are often changing. Therefore, the graphic is intended to be a generalization of vendor risk and project impact. The location of a tier of vendors or a specific vendor can change as project conditions change, such as a shift in the project’s critical path

2Source Blue – Facility Equipment Cost Index (2022 Second Quarter Update).

3Building Congress & Exchange – Prolonged supply chain turmoil drives new business practices. September 16, 2022.

4Associated General Contractors of America (ACG) – Construction Workforce Shortages Risk Undermining Infrastructure Projects as Most Contractors Struggle to Fill Open Positions (August 31, 2022).

5Associated Builders and Contractors (ABC) – ABC’s Construction Backlog Inches Lower in June; Contractor Confidence Falters (July 22, 2022).

6Associated Builders and Contractors (ABC) – ABC’s Construction Backlog Inches Lower in June; Contractor Confidence Falters (July 22, 2022).