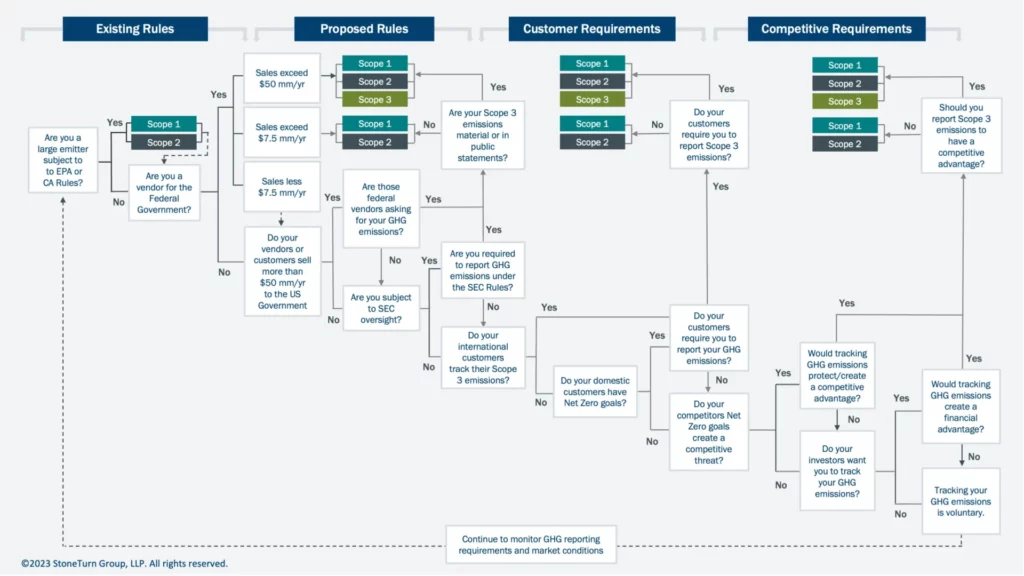

Disclosures around greenhouse gas emissions haven’t received the same headlines as net zero, but regulatory requirements are growing. Organizations can take steps to ensure they are ready for both existing and proposed rules on the horizon. This article discusses forthcoming rules, what they may mean for organizations, and how to prepare. Is your firm going to be subject to GHG emissions tracking and reporting requirements? Click the image below or follow the decision tree here to find out.

Although much has been written about the tightening net around net zero claims, not as much attention has been paid to the widening net around companies required to track and report their greenhouse gas (GHG) emissions.

A number of factors are converging to expand carbon emissions reporting requirements on both large companies that are not already doing so and smaller companies who sell goods and services to those companies. These factors include proposed rules at the federal level, increased expectations and contractual requirements from customers, and market pressures imposed by competitors and investors focused on environmental, social and governance (ESG) risk mitigation. Your company’s decision regarding whether or not it should perform a carbon inventory and pursue a carbon reduction program should consider both mandatory requirements and market demand.

Existing Rules

For most U.S. companies, performing a carbon inventory has been a voluntary endeavor. Currently, the Environmental Protection Agency (EPA) requires around 8,000 of the largest GHG emitting facilities to report carbon emissions under the Clean Air Act (40 CFR Part 98). Reporting companies generally include power plants, oil and gas suppliers, refineries, chemical manufacturers, and metals and mining operations, of which there are 966 suppliers of fuel and industrial gases. Direct emissions from those sites in 2021 totaled 2.71 billion metric tons of carbon dioxide equivalent (CO2e), or around 43 percent of the total emissions the EPA estimates is generated by the entire country.

Proposed Rules

In addition to existing rules, a proposed rule by the Defense Department, General Services Administration, and NASA would require major suppliers to the federal government to report their GHG emissions. Specifically:

- Federal Suppliers: Under the proposed rules, Federal contractors that sell more than $7.5 million per year to the government are required to track and report their direct emissions (Scope 1) as well as emissions from upstream combustion that generates energy, heat and steam used in operations (Scope 2). Contractors who are not small businesses that sell more than $50 million per year to the government also have to report relevant upstream vendor emissions and downstream customer emissions associated with their goods and services (Scope 3), disclose potential climate-related risks, and submit a science-based plan for reducing GHG emissions.

- Publicly Traded Companies: Proposed SEC rules, due to be issued before the end of the year, could require reporting of direct carbon emissions from all domestic registrants and foreign private issuers. Although this broad mandate may be relaxed in the final rule, or through Supreme Court decisions, some form of reporting is still likely to be required by the SEC tied to support for material disclosures regarding carbon emission levels, decarbonization goals, and progress in meeting those goals. To the extent Scope 3 emissions are material, or goals surrounding Scope 3 emissions have been made public, similar information reporting requirements will extend to relevant upstream vendors and downstream customers.

- Financial Funds Claiming ESG Attributes: Any financial offering subject to SEC jurisdiction that includes a claim regarding ESG characteristics such as environmental scores, emissions levels, or Net Zero goals, will have to support those claims with carbon reporting. This requirement will extend carbon reporting requirements to the companies that those investors are including in their ESG funds.

These federal requirements are anticipated to be issued before the end of the year, with the following year likely setting enforcement precedent.

Customer Requirements

Regardless of whether federal rules are enforced in the next administration, customers are exerting increasing pressure on their suppliers to track, report and reduce carbon emissions.

International companies and governments are taking the lead in requesting climate action plans and carbon inventories from their vendors. International businesses, including those subsidiaries of U.S. companies, already are facing carbon reporting requirements under German and British rules, as well as the International Financial Reporting Standards (IFRS) S1 and S2 standards that were issued this summer. Singapore is championing the proposed International Sustainability Standards Board proposal to require mandatory climate reporting for listed companies and large non-listed firms.

For U.S. companies that sell goods and services overseas, vendor requirements may come in the form of proposal scoring criteria that awards higher points for having a sustainability plan. Other companies include provision of a sustainability plan alongside other standard terms and conditions such as notice of insurance and a Form W-9. Failure to comply can result in loss of market share.

Competitive Requirements

In some cases, a climate action plan and carbon inventory are not only required to maintain competitive position, but can create competitive advantage. If your competition has declared Net Zero goals and established their own sustainability plans, your firm may need one simply to be able to compete. If your competitors do not have a climate action plan, being a first mover could create a competitive advantage. If tracking GHG emissions and having a carbon reduction plan creates a competitive advantage that outweighs the costs, it makes business sense to move forward regardless of mandatory requirements.

Investors also may impose a set of competitive requirements. Private equity funds with a focus on sustainability will require carbon emissions reporting and broader ESG scores. Large investors such as pension funds are focused on socially responsible investing and climate risk mitigation. As with customers, it is important to know your market and which investors you are looking to attract. In general, those looking to mitigate their regulatory risks will want to see a climate action plan and carbon inventory, whereas those investors who do not incorporate ESG into their investment decisions will not. Having a carbon inventory and GHG emissions reduction plan ready could facilitate financing opportunities.

Voluntary Efforts vs Mandates

A series of pressures are expanding the number of companies that are required to track and report their carbon emissions. Although reporting has been limited to the largest emitters and voluntary efforts, U.S. and international requirements that extend net zero requirements beyond those companies already are here and expanding. Market requirements are exerting additional pressure, in some cases requiring carbon inventories and reports to maintain, if not gain, competitive market advantage. The decision tree below can help you determine whether your company is captured by the net of requirements. If you remain one of the few firms that is not captured by the widening net zero requirements, stay alert. Know your market, weigh the risks, and be ready to respond accordingly.

Is your firm going to be subject to GHG emissions tracking and reporting requirements? Click the image below to follow the decision tree to find out.