The Economic Pulse of Latin America: A Gentle Acceleration

The economic forecast for Latin America and the Caribbean for 2025 suggests a steady upward trend. GDP grew by 2.4% in 2024 and is expected to have a projected growth of 2.5% in 2025, according to International Monetary Fund (IMF).

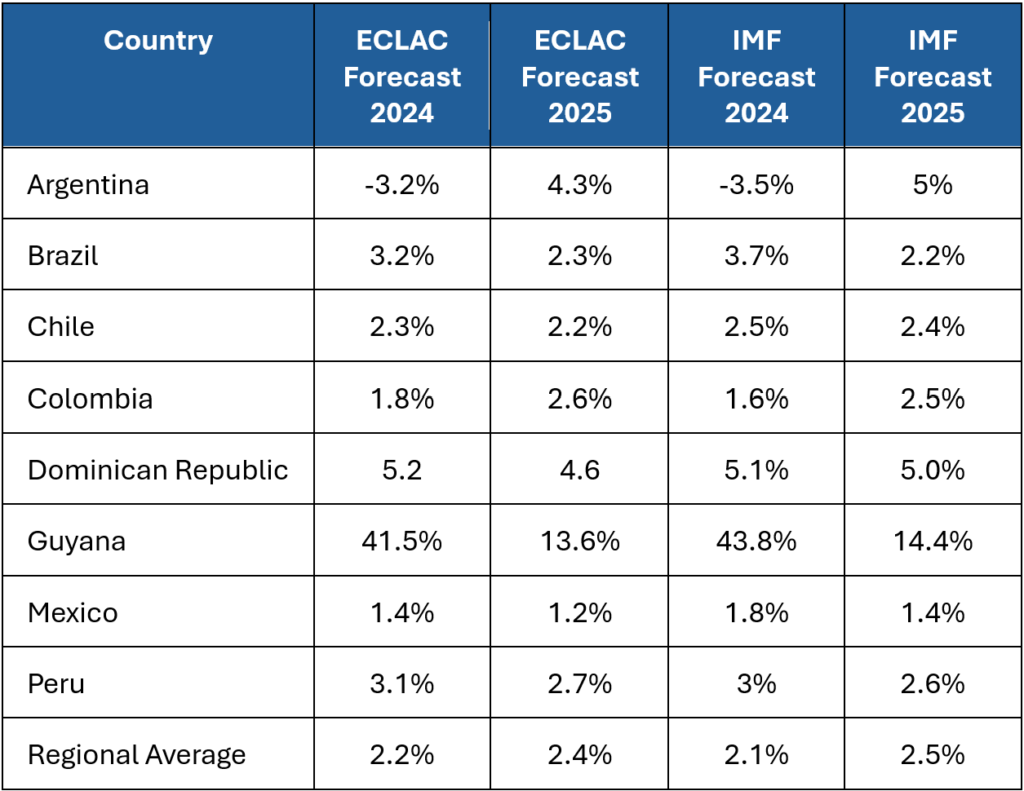

Inflation across much of Latin America has been on a downward trajectory. This could pave the way for increased economic activity. However, the pace of growth varies considerably across the region. South America is anticipated to expand by 2.6% in 2025, while Central America is projected to grow slightly faster at 2.9%, and the Caribbean (excluding Guyana) at 2.6%. At the country level, the Dominican Republic stands out with a forecasted high growth rate for 2025, potentially followed by Argentina and Paraguay. In contrast, growth in Brazil and Mexico, two of the region’s largest economies, is expected to be more subdued. While Argentina is predicted to experience a significant economic turnaround in 2025, the situation continues to evolve given the IMF’s recent US$20 billion Extended Fund Facility (EFF) for the nation. This diverse economic picture underscores the need for investors to adopt a nuanced, country-specific approach, while considering repercussions from the shifts in neighboring countries and the global stage.

Table 1: Projected Growth in Latin America 2024-2025

Inflation and Interest Rates: A Mixed Bag

The significant decline in inflation across most of Latin America since its 2022 peak is a welcome sign. The median regional inflation rate has fallen considerably and is projected to ease further in 2025. This has allowed many central banks to begin easing monetary policy. While this trend is generally positive, Brazil stands out as an exception, having initiated a rate hiking cycle in September 2024 to combat inflation and support its currency. This divergence in monetary policy highlights the varied economic pressures within the region.

The Political Landscape: Navigating Elections and Stability

The political map of Latin America remains active, with a series of elections in 2024 and more anticipated in 2025, each carrying the potential for policy shifts that could impact investment. Recent elections in El Salvador, the Dominican Republic, Mexico, Venezuela, and Uruguay have ushered in new political dynamics. Looking ahead to 2025, Ecuador, Bolivia, Chile, and Honduras are among the nations scheduled to hold presidential elections. Argentina will also hold crucial midterm elections in October 2025. These electoral events introduce a degree of uncertainty that investors must factor into their strategies.

Beyond the electoral calendar, broader political trends continue to shape the region. Political instability and governance issues persist, often stemming from weak institutions and challenges with corruption. However, there are indications of a potential shift towards political moderation in some countries, such as Chile. Conversely, the growing influence of organized crime in several nations, like Ecuador and Chile, poses a significant threat to governance and security. This complex interplay of political factors requires careful monitoring and assessment by investors as they seek to deploy capital in new regions.

The U.S. Policy Pivot: Implications for Latin American Investments

The new administration in the United States has brought a renewed focus on Latin America, particularly concerning trade, immigration, and drug flows. This has created a degree of uncertainty for investors in the region, especially for countries like Mexico with strong trade ties to the U.S. The increased tariffs and other protectionist measures under the “America First” approach are a key concern. While existing trade agreements like the United States-Mexico-Canada Agreement (USMCA) provide a framework, the possibility of new tariffs being used as leverage on issues beyond trade cannot be discounted.

Despite these potential headwinds, the global trend of nearshoring presents a significant opportunity for Latin American countries. Most of the countries in the region were imposed the “minimum” 10% tariff by the Trump administration, far lower than many Asian countries that export significantly to the United States, such as China (125%), India (26%) and Vietnam (46%). As companies seek to diversify supply chains and enhance resilience, Latin America’s proximity to the U.S. makes it an attractive destination for foreign direct investment (FDI).

The U.S. administration’s focus on reducing migration and drug flows could lead to increased engagement with Latin America, potentially impacting economic policies and creating both challenges and opportunities for the region. Investors need to closely monitor policy developments in areas such as trade agreements, investment security, and foreign assistance to understand the evolving landscape.

Unveiling Investment Opportunities in a Dynamic Region

Despite the uncertainties, Latin America offers compelling investment opportunities across several sectors:

Renewable Energy

The renewable energy sector is experiencing substantial growth, driven by decreasing technology costs, global commitments to emissions reduction, and the region’s abundant natural resources. Non-conventional sources like solar and wind are leading the way, with significant potential in countries like Brazil, Chile, Colombia, and Mexico. Latin America’s existing leadership in green energy positions it as an attractive destination for investors seeking to capitalize on the global energy transition.

Technology and Digital Transformation

The technology and digital transformation sectors are booming across Latin America. The region’s digital economy is on a rapid growth trajectory, with significant opportunities in fintech, e-commerce, and software development. The increasing number of highly valued tech startups (unicorns) indicates a vibrant innovation ecosystem.

Nearshoring: Capitalizing on Supply Chain Shifts

Nearshoring presents another significant investment opportunity. As U.S. companies seek to diversify their supply chains and reduce the impact of the current administration’s tariffs, Latin America is emerging as a key destination for nearshore investment. Sectors such as manufacturing, automotive, textiles, pharmaceuticals, and technology are poised to benefit.

Acknowledging and Addressing the Inherent Risks

Investing in Latin America requires a clear understanding of the risks involved:

Political and Economic Instability

Political volatility and the potential for policy shifts following elections are ongoing concerns. Economic volatility, including currency fluctuations and inflation, also remains a factor. Geopolitical and economic risk assessments can help identify and mitigate these risks.

Regulatory and Security Concerns

Navigating the diverse regulatory frameworks across the region can be challenging. Security concerns, particularly related to organized crime and cybersecurity, also demand attention. Security assessments are essential for investors in certain parts of Latin America, where the security situation can have direct and devastating impacts on investments.

Compliance Challenges

Corruption and bribery remain significant issues in many Latin American countries. Adhering to evolving Environmental, Social, and Governance (ESG) standards is also increasingly important on the global stage. Performing a robust assessment of an investment target’s compliance practices and internal controls can help avoid a multitude of issues down the line. Risk assessments and gap analyses can also be conducted post-investment, to make sure that the investment target’s compliance practices are adequate.

Strategic Intelligence: A Cornerstone of Successful Investment

Latin America in 2025 presents a landscape of both promise and peril. While economic growth is expected to continue at a moderate pace and exciting opportunities emerge in key sectors, investors must be vigilant in navigating the region’s inherent risks. By conducting strategic intelligence and partnering with regional and industry experts, investors can chart a successful course and unlock the significant potential that Latin America offers for long-term value creation.

Strategic due diligence goes beyond the standard financial and legal checks to incorporate deep contextual intelligence, on-the-ground insight, and risk-informed decision-making. This level of scrutiny is essential in a region with dynamic political climates, evolving regulatory frameworks, and pronounced differences between countries.

If you have any questions or would like to discuss these topics please reach out to Carlos Flavio Lopes.

To receive StoneTurn Insights, sign up for our newsletter.