In 2024, Latin America stands out as an optimal destination for investors, marked by a series of positive developments. From tax reforms to lower interest rates, these elements together sketch a promising picture for those looking to invest in Latin America’s dynamic markets. There are five key trends that make the region an attractive opportunity for investors seeking to maximize their portfolio and mitigate risk in the process.

1. Positive international indicators and projections

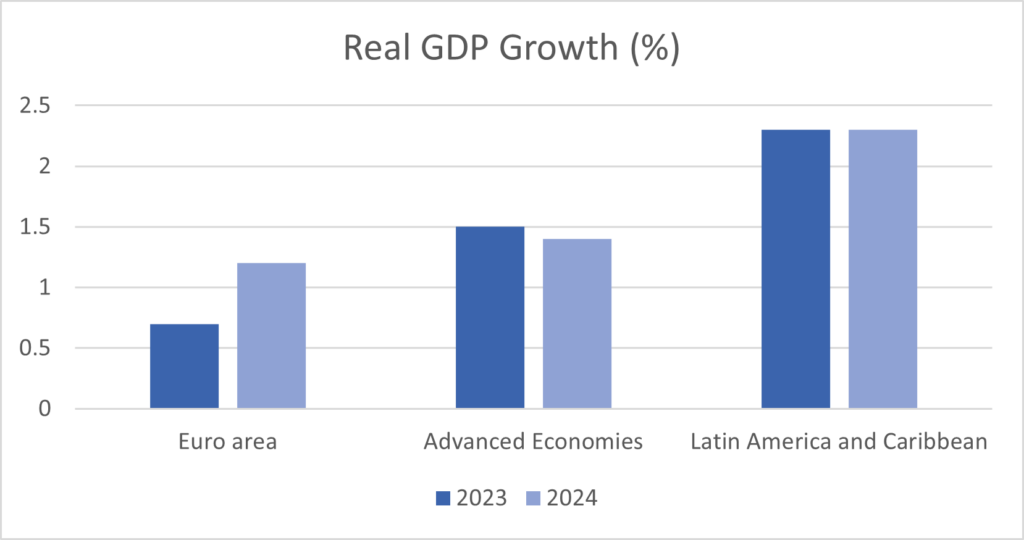

According to the IMF, Latin America and the Caribbean have displayed a stronger-than-expected pandemic recovery and continued resilience in 2023. With an average GDP growth of 2.3% in 2023 and expected growth of 2.3% in 2024, they are outpacing the growth projections for advanced economies in 2023 and 2024, which is respectively, 1.5% and 1.4%.

Graph 1.

Source: IMF World Economic Outlook database.

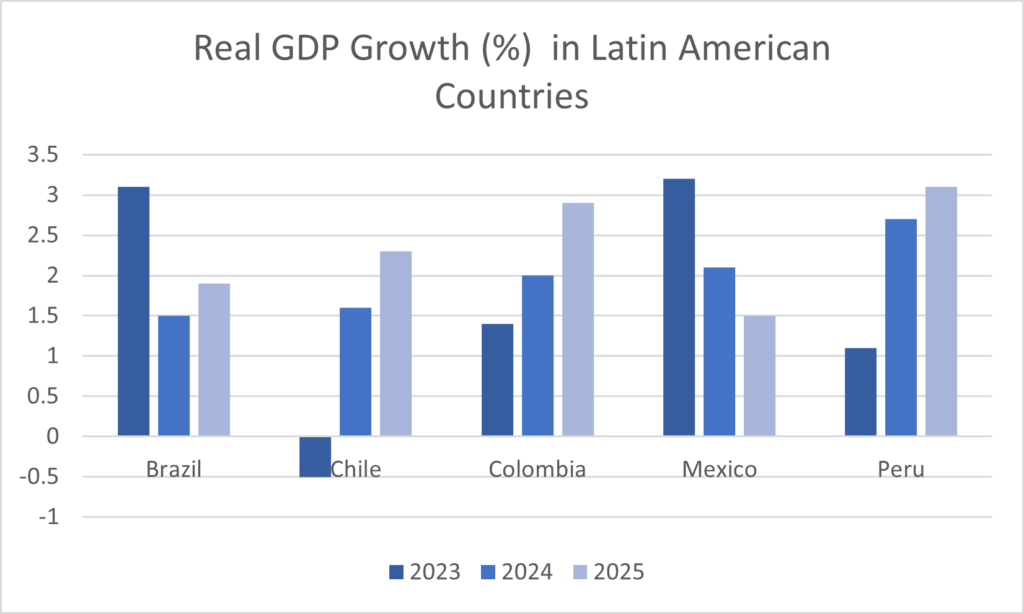

Graph 2.

Source: IMF World Economic Outlook database.

Another positive sign for investment in Latin America is the steady decline of inflation. IMF data notes that inflation in the region (excluding Argentina and Venezuela) has been declining, expected to reach 5% in 2023, compared to 7.8% in 2022 . As of May 2024, the IMF noted Milei’s plan and IMF loan review “has resulted in faster-than-anticipated progress in restoring macroeconomic stability and bringing the program firmly back on track.

2. Lower interest rates that create opportunities for IPOs in Latin America

Across the world, interest rates are dropping. These lower rates might create an opportunity for investors in initial public offerings (IPOs) in Latin America, particularly in Brazil. Economists estimate that at least 19 Brazilian companies will start IPOs in 2024, ending a two-year IPO drought in the country. Several economists now foresee that companies in fintech, real estate, energy and infrastructure will join the Brazilian stock market.

Brazil has presented increasingly robust economic growth. With a GDP of $2.13 trillion, it became the world’s ninth largest economy in 2023, according to the IMF, jumping two positions on the list. The IMF argues that sustained growth is expected, and by 2026 Brazil could rise to eighth largest economy on the planet, with an estimated GDP of $2.476 trillion.

3. Brazil’s tax reform

In December 2023, after 30 years in the making, the Brazilian Congress finally approved tax reform that will merge five different taxes on goods and services into two value-added taxes (VAT), one federal and one local. Currently, Brazil’s federal government, all 27 states and over 5,000 municipalities set their own taxes. Specialists say that simplifying this tax system would make investing in Brazil cheaper and Brazilian products more competitive. There may also be effects inside Brazil, since the tax reform is expected to increase the population’s purchasing power. Furthermore, Brazilian economists point out that adopting VAT in other countries resulted in higher productivity and foreign direct investment, and projected that it could elevate Brazil’s potential GDP between 12% to 20% over the next 15 years.

4. Investors show increasing optimism about Brazil

When President Lula was elected for his third term, many investors were wary of a possible return to the fiscal profligacy that characterized the previous government of his Workers’ Party, which led to a recession in 2016. However, six months after he took office, markets reacted positively to his economic policies. A poll of 94 Brazilian fund managers and analysts revealed that in August 2023, just 44% had an unfavorable view of the government, down from 90% in March of that year.

Inflation is also declining, dropping from 12% in April 2022 to 3.2% in August 2023. Additionally, in December 2023, after the approval of the tax reform, S&P Global Ratings elevated Brazil’s credit rating. According to OECD data, this combination of factors has made Brazil the world’s third largest FDI recipient among OECD economies in 2022, and second largest in 2023, standing out as a prime FDI destination among other developing nations.

5. Long-standing regional stability & political alignment

Assessing risk is essential for any investment, and the risk of regional and political instability is among the top concerns for foreign investors. At present, Latin America is considered relatively stable when compared to other developing regions. While global instability has affected business in Europe (Russia-Ukraine), the Middle East (Israel-Hamas, Yemen and Syria), Africa (Somalia, Burkina Faso, Sudan), and Asia (South China Sea, Taiwan, North Korea), Latin America has remained relatively peaceful.

For companies and investors in developed countries, it is increasingly risky, both reputationally and financially, to invest in or buy from certain countries. Offshoring is being replaced with friend-shoring or ally-shoring to avoid those risks, and Latin America only stands to gain from this.

How to mitigate risks while investing in Latin America

While the signs are positive for investing in Latin America, we must not forget that it is still a relatively high-risk jurisdiction for foreign investment.

Corruption remains a major concern in Latin America. Transparency International recently released its Corruption Perception Index for 2023, which ranks 180 countries from the lowest perception (1) to the highest (180). Brazil dropped ten spots in the ranking, while other Latin American countries fell even more, such as in Argentina, Ecuador, and Peru. Corruption also has a negative impact on political stability. Peru, for example, had seven presidents over six years, with three of them serving prison sentences at the same time.

Considering this risky environment, strong business intelligence and risk mitigation tactics are essential in safeguarding investments. Those seeking to invest in Latin America must ensure the resources identifying these risks have first-hand knowledge of the region, as many risk scenarios may contain cultural or geographical nuance, such as projects requiring government contracts or new regulations and legislation.

Simply put, conducting proper due diligence prior to the investment is the best risk mitigation strategy. In-depth analyses of the investment target’s internal controls, their procedures to avoid fraud and corruption, and third-party risk assessments for business partners and vendors are important.

Excitement is abound in Latin America for investors, and with the right risk mitigation steps, investors can start on the right foot for long-term value.

If you would like to discuss any of the issues raised in this article please reach out to Carlos Flávio Lopes.

To receive StoneTurn Insights, sign up for our newsletter.