New Government in 2023

On October 30, 2022, former president Luis Inácio Lula da Silva (Lula) was elected as Brazil’s next president. Despite receiving the largest number of votes ever for any candidate in Brazil’s democratic history, Lula beat the incumbent president Jair Messias Bolsonaro by the smallest margin ever in a Brazilian presidential election; 50.9% to 49.1%.1 Lula will be sworn in on January 1, 2023 for his third time, after having served as president from 2003 to 2010. A founding member of the Workers’ Party (PT), Lula is seen as a left-wing politician, which is diametrically opposed to Bolsonaro, who is the leader of Brazil’s far right political movement.

President Lula will be checked by a newly elected Congress and Senate that are among the most conservative ever. President Bolsonaro was able to elect numerous supporters to both houses, who will work actively to oppose any radical policies that Lula could propose. While this will create some difficulty for Lula to approve much needed reforms, such as simplifying the country’s tax code, it should create some stability, which generally favors investment. President Lula’s team has started providing glimpses into what his future cabinet will look like. His economic team is expected to include well-known economists with successful track records in fostering growth and stability, which will help ease tensions in the market. In the first week after his election, the Brazilian stock exchange climbed 3%2 and the Brazilian Real increased by 4.5% compared to the U.S. Dollar,3 showing that there is some optimism now that the elections are over.

Lula’s election should also bring an improvement in Brazil’s diplomatic relationships abroad, as he tends to be a more popular figure globally than President Bolsonaro. During his presidency, Lula was commended for being able to collaborate with all sides of the political spectrum, “from George W. Bush to Hugo Chavez”.

There is also an expectation of a shift in the country’s environmental policies towards preservation, which was not a priority of the Bolsonaro administration. After Lula’s election, the Norwegian government has already stated that it is ready to bring back a fund for preservation of the Amazon worth more than USD 500 million, which had been halted by Bolsonaro in 2019. ESG-conscious investors will welcome these changes. Nordea, the Finland-based bank, has also stated that it is considering lifting a suspension on investing in Brazilian bonds that had been instated in 2019.

Positive Indicators in the Economy

According to data from the Organization for Economic Co-operation and Development (OECD), Brazil was the third largest recipient of foreign direct investment in the first half of 2022, behind only the United States and China. Brazil also stands to receive greater investment due to countries increasingly seeking to replace off-shoring in countries like China4 with friendly-shoring locales, selecting politically aligned or neutral partners to do business with.

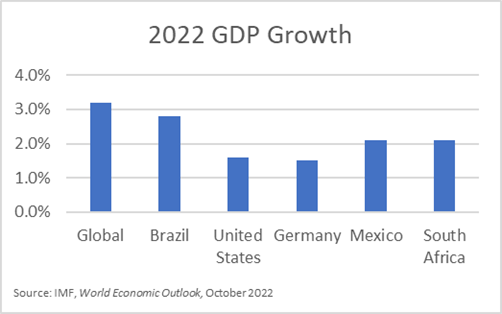

Compared to other markets, the macroeconomic picture for Brazil in 2023 is relatively positive. Lula will be inheriting an economy that has begun to recover from the Covid pandemic and which is expected to grow by 2.8% in 2022 according to the International Monetary Fund (IMF).5 This is below the IMF’s projection for global GDP growth in 2022, but is ahead of several developed and developing nations. On the other hand, inflation in 2022 has been relatively small, with Brazil’s being the fourth smallest of all the G20 countries between January and September of 2022.

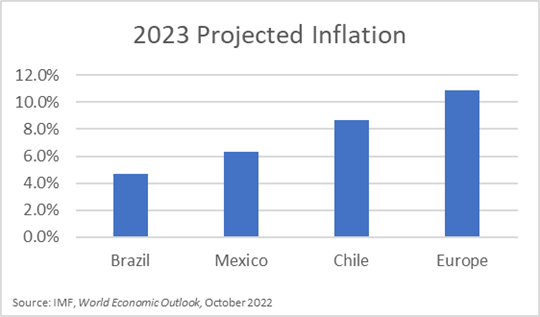

In 2023, Brazil’s projected GDP growth is only 1%, per the IMF, while the global GDP is expected to grow by 2.7% and emerging and developing economies are expected to grow by 3.7%. The IMF projects that Brazil’s inflation in 2023 will be 4.7%, which is low compared to other economies:

Interest rates in Brazil are also expected to start declining towards the middle or third quarter of next year. Additionally, the current exchange rate of the Brazilian Real, which compared to the US Dollar has suffered a devaluation of 30% since the start of the pandemic, also provides opportunities for investments.6 Finally, when compared to other developing countries that tend to receive foreign investments, Brazil is seen as relatively stable and free of geopolitical risks.

These factors are likely to help heat up the economy and provide a better environment, especially for private equity investments.

Opportunity for Private Equity

Despite the turmoil and uncertainties of an election year, private equity and venture capital investments in Brazil grew by more than 13% in the first half of 2022 compared to the same period last year. A study published by the Brazilian Association of Private Equity and Venture Capital (ABVCAP) highlighted financial services and information technology as the main investment targets.7

The Brazilian stock market is also expected to see a resurgence in activity in 2023. Throughout 2022, almost 30 companies cancelled their initial public offerings on the Brazilian stock exchange due to unfavorable economic conditions and uncertainty. Analysts are predicting that there will be at least 15 Brazilian IPOs in 2023, including some conducted by private equity firms looking to exit their investments.

With a stable political and economic outlook, along with a devalued currency and with investors moving away from other emerging markets, Brazil is a prime target for investments in 2023.

If you would like to discuss any of the issues raised in this article please reach out to Carlos Flávio Lopes.

1https://resultados.tse.jus.br

2https://www.b3.com.br/pt_br/market-data-e-indices/indices/indices-amplos/indice-ibovespa-ibovespa-estatisticas-historicas.htm

3https://www.bcb.gov.br/estabilidadefinanceira/historicocotacoes

4https://www.oecd.org/investment/investment-policy/FDI-in-Figures-October-2022.pdf

5https://www.imf.org/en/Publications/WEO/Issues/2022/10/11/world-economic-outlook-october-2022

6https://www.bcb.gov.br/estabilidadefinanceira/historicocotacoes

7https://www.abvcap.com.br/Download/Estudos/5329.pdf